Our oil and gas talent search group descended upon Houston with a chock-a-block day full of meetings with clients in downtown Houston on Wednesday last week. My initial opinion after visiting with our clients was that we were in for another year of good search assignments but would be swimming against the current more in terms of momentum for hiring experienced oil and gas professionals. Our clients are hiring, but very selectively, and recent M&A activity is resulting in some very talented individuals hitting the streets in a compressed time period. This influx of talent is availing hiring managers the luxury of seeing formerly passive talent, now actively competing for limited spots. However, talented people with the right basin and type of experience are getting interviews and some multiple offers.

The NAPE 2019 buzz:

Given our Wednesday visits, we weren’t sure if the mood at NAPE would be similar to our clients’ outlooks. Interestingly, the mood was a bit more upbeat and we would describe it as cautiously optimistic. Although we haven’t seen an official number, 12,000+ attendees were proclaimed registered by NAPE organizers which seemed to be accurate as Thursday’s trade show floor was very full, maybe not 2007-2008 level, but still very strong. One CEO of a specialty O&G software company told us, “Companies have adjusted to a lower price band and have figured out how to make money at $50-55, so business is good.” E&P operating companies working Eagle Ford, Permian along with emerging plays in New Mexico and Austin Chalk appeared to be more enthusiastic vs. Tuscaloosa trend and SCOOP/STACK players.

1) Private Equity is tapping the brakes in zealously funding acreage acquisition strategies and instead investing more robustly in Mineral rights aggregation and non-operated property companies.

2) Data Analytics/Artificial Intelligence, once an incubator idea, is now firmly planted in large to medium-sized Operating Co.’s changing the makeup of talent focused on IT developers and statisticians vs. petroleum engineers or geologists. Will be interesting to see how this develops.

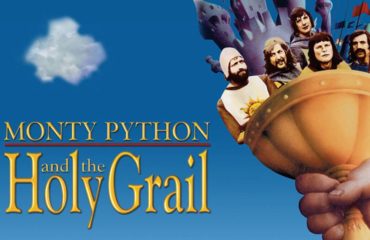

3) Monty Python’s Holy Grail, “I’m not dead yet”, quote is quite appropriate and companies that can be profitable in a lower price range will not only survive but prosper, albeit at a much more controlled pace.

So after a very enjoyable, busy couple of days we and thousands of others are back at our desks continuing to do what we do best. In our world that’s being experts of the energy industry’s people needs, seeking out passive top talent and discreetly matching them up with great clients/opportunities. As Dorothy once opined in the Wizard of Oz, “There’s no place like home.”